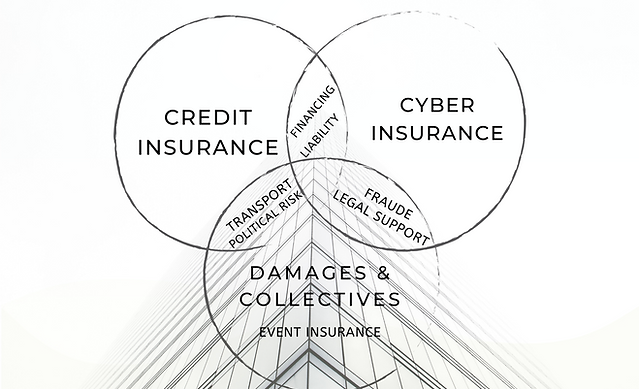

CREDIT INSURANCE

Trust is the key to doing business. Sometimes external facteurs can be detrimental to the financial situation of your clients (non payment of a client, fraud, fire casualty, strike, an event, demise of director). These situations should not affect your company and how it does business.

Our role is to advise you in the elaboration of contractual clauses that correspond best to your strategy and development.

CYBER-RISK

By 2030, there will be between 10 and 100 billion connected objects, tasks will be increasingly automated without human intervention, and virtually all strategic data will be linked to a connected network.

The cyber-risk insurance market has become a major preoccupation for insurance companies and their clients. Indeed, the market represents 0,31% to 0,56% of the global GDP whereas natural disasters represent only 0,28% of the GDP.

We operate within this market with our partners, adapting solutions according to company size and their revenue.

FINANCE

Neopontem offers tailor-made solutions to increase and secure your cash flow from order to collection.

A financing solution such as factoring is perfectly suited to the increasing digitalization of companies today.

Our services consist of facilitating and optimizing the process of implementing solutions such as factoring.

TRANSPORT INSURANCE

It's important to underline that 84% of international exchanges are done by sea.

Over 20% of insurance claims involve theft and almost half are caused by issues with storage, stowage and materials handling.

In order to optimize your coverage and the cost of risk transfer, we adapt your insurance contracts according to container shipping modes and your choice of insurance policies (for example, by expedition, open policy, equipment floater insurance).

LIABILITY

INSURANCE

The daily interactions of your business activity may provoke damages (to persons, material or immaterial) to clients, suppliers, or visitors.

In such situations, you are obliged to repair damages inflicted on a third party. It is therefore essential to have the necessary insurance coverage to avoid financial consequences, which can have a drastic impact on your business activity and results.